How to Manually Add a Transaction in CRPTM

How to Manually Add a Transaction in CRPTM

Managing and Reporting your cryptocurrency transactions is essential when it comes to accurately calculating your tax liabilities. If there are transactions from unsupported exchanges/wallets or there are non-exchange transactions, these can be added manually or through CSV to your CRPTM account.

If you have a few transactions to add, you can add easily add them through our ”Add Transaction” feature. Adding transactions manually can assist in addressing any discrepancies in synchronized or potentially absent transactions that have not been imported into CRPTM.

We recommend you add all your wallets or exchanges to your CRPTM account before adding or editing transactions manually to ensure your complete transaction history has been added and to avoid duplicate transactions. With automatic syncing, the need for manual edits will be eliminated.

Once you have added all your wallets or exchanges, follow the steps listed below to manually add a transaction.

- Login to your CRPTM account

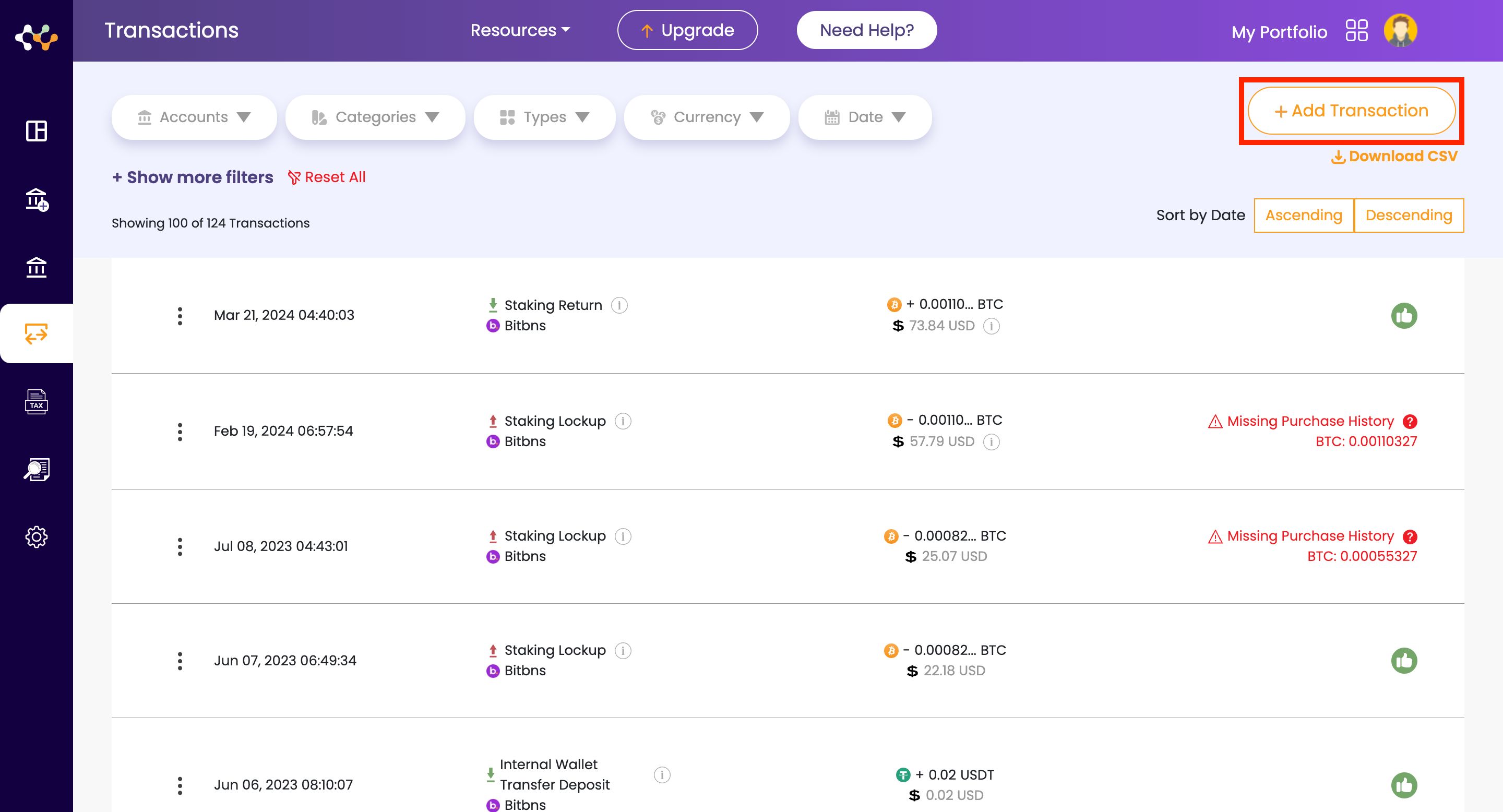

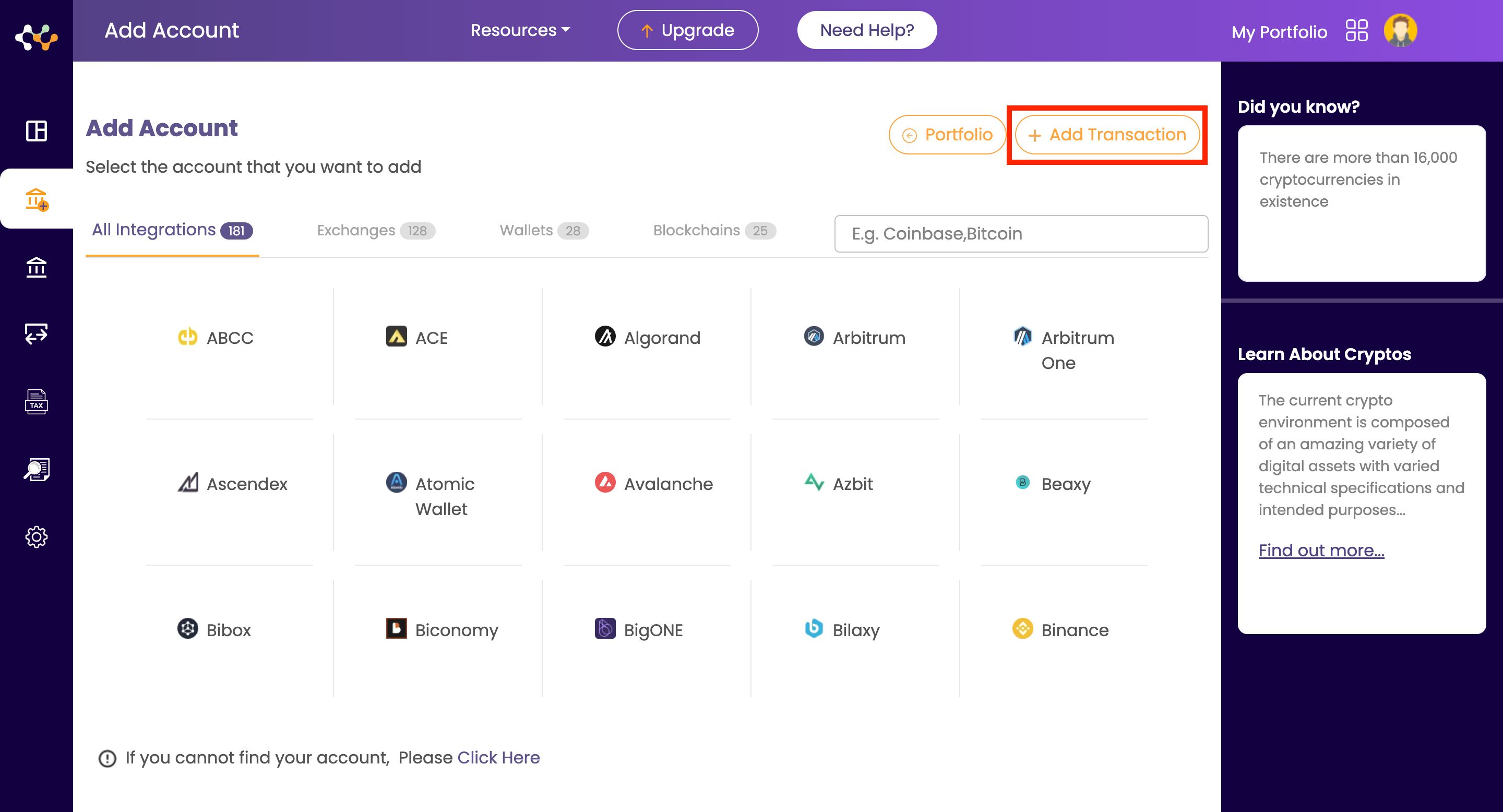

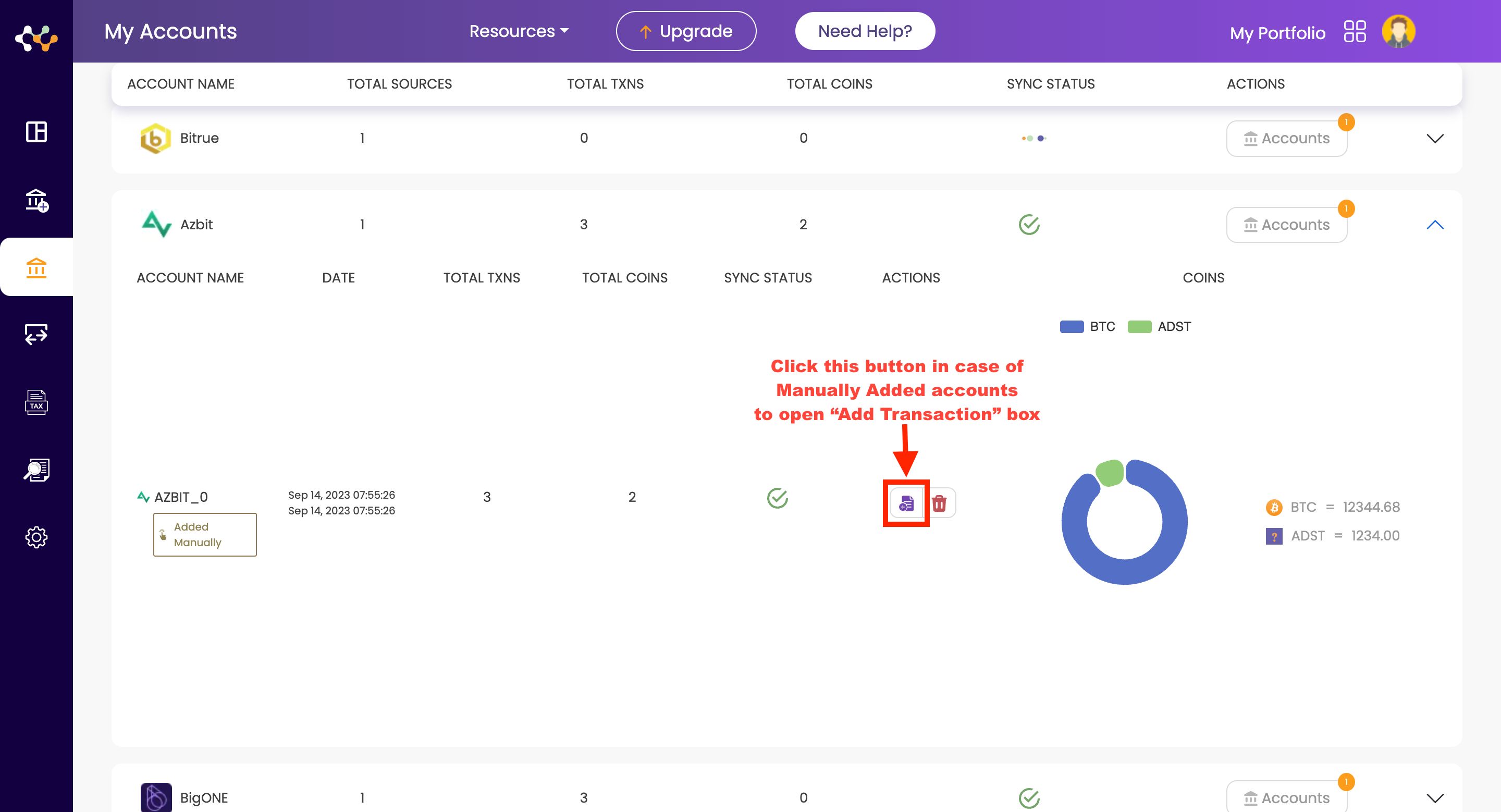

- You can add the transactions from

(b) Add Account Page

(b) Add Account Page (c) My Accounts Page

(c) My Accounts Page

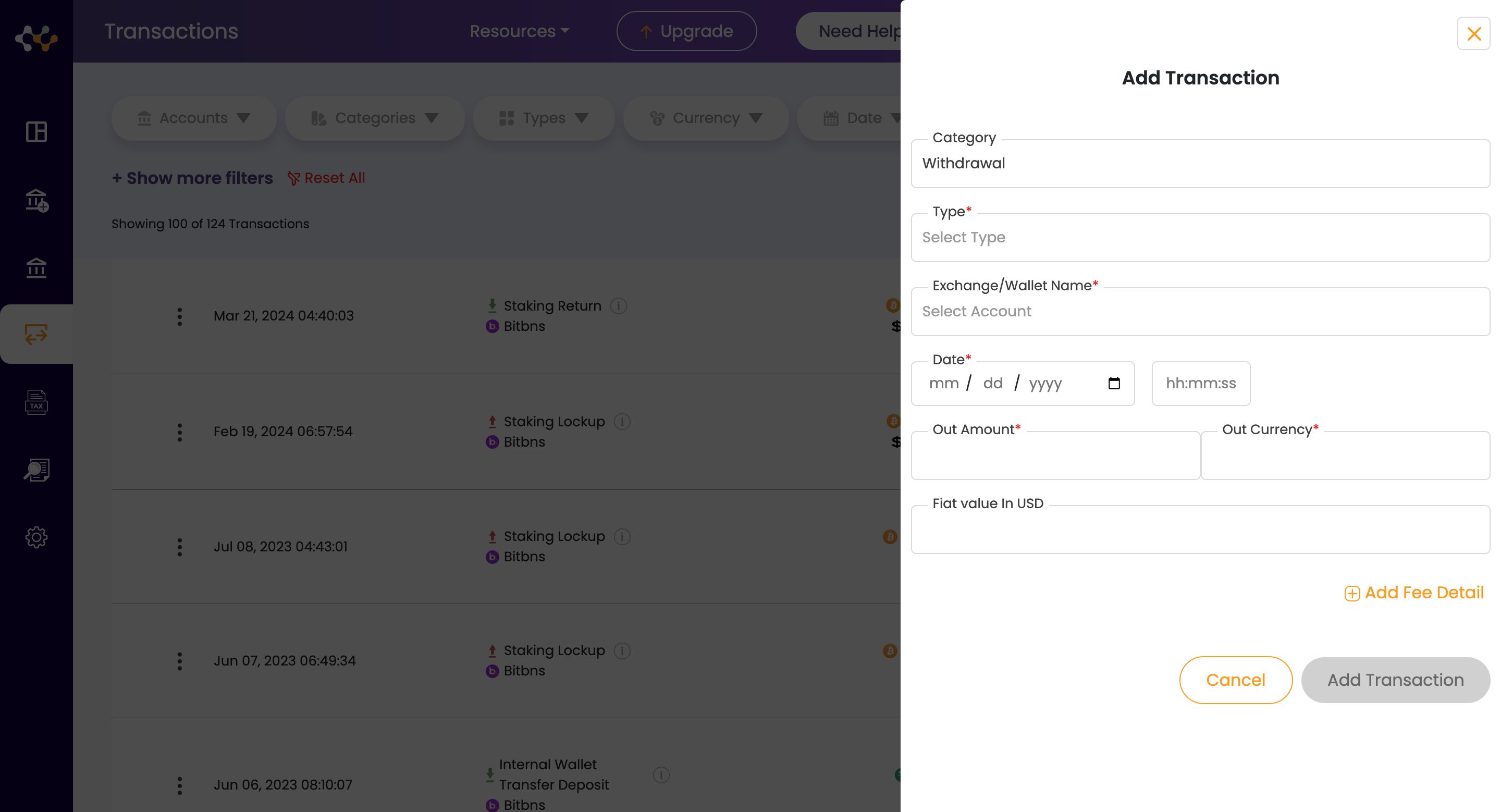

- You will be presented with a form/ template where you can fill in the details of each transaction.

- Select the crypto exchange or wallet name where the transaction happened.

- Enter the transaction date and time in UTC. You can use online UTC converter tools where you can easily convert the date time to UTC time. Simply search for "time to UTC converter" in your preferred search engine to find suitable tools

- Select the transaction category. In CRPTM we have divided into three main types:

(a) For Deposit type of transactions - Enter the In amount and In currency.

(b) For Withdrawal type of transactions - Enter the Out amount and Out currency.

(c) For Trade type of transactions - Enter amount and currency for both In and Out

Select the transaction type in CRPTM. We have multiple transaction types such as :

For Trade types -- Buy

- Sell

- Trade

- Incoming

- Gift Received

- Hard Forks, Mining and many more deposit types.

- Outgoing

- Gift Sent, Donation

- Lost, Stolen and many more withdrawal types.

- Add FIAT Value in USD - It is optional field. If you know the In or Out Value in USD then add it. Otherwise we will handle it.

- Enter the transaction fee associated with the transaction.

- Select the currency for the transaction fees.

- Select “Fee FIAT Value” for Fee FIAT Value in USD. It is optional field. If you know the fee value in USD then add it. Otherwise we will handle it.

Select the value for “Is In/Out amount inclusive of the Fee?” from the dropdown.

Fees play an important role from a tax perspective as they can have implications on the calculation of gains and losses for tax reporting purposes. When determining the capital gains tax owed, the fees associated with acquiring or selling cryptocurrency are factored into the overall gain or loss calculation. Subtracting the fees from the sale proceeds can help accurately determine the taxable gain or loss.

Mostly Exchanges charge fees for the trades and the withdrawals. They can either give the net amount deposited or withdrawal which includes the fee, or they can give fee and the deposited or withdrawal amount separately.

Is In/Out amount inclusive of the Fee? “yes” indicates that total of in/out transaction amount includes fee amount as well.Is In/Out amount inclusive of the Fee? “no” indicates that total of in/out transaction amount does not includes fee amount.- Review all the information you have entered above and Click on the ‘Add Transaction’ button.

FAQs

- Correction of errors or missing data: If there are errors in imported transactions or if you see the missing transactions imported through API, then you need to manually add them to ensure accurate tax reporting. Many exchanges doesnt give the data of conversion (like Ascendex) or

- Offline or hardware wallet transactions: Transactions made using offline wallets or hardware wallets often require manual entry because they are not directly connected to the internet.

- Airdrops and forks: Certain crypto events like airdrops or forks may require manual entry to record the receipt of new tokens or the splitting of existing tokens.